See your rates right now – instantly

Rates start at $7.49 per month

($7.49 rate is for $2,000 benefit for Female, non-smoker age 50, good health)

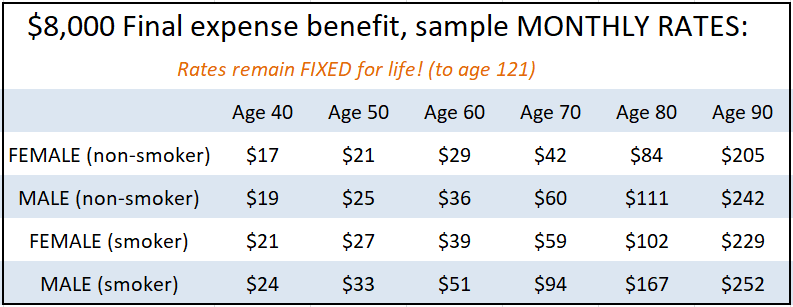

Our SENIOR CARE plan is a WHOLE LIFE insurance that will help pay for FINAL EXPENSES and give you and your family peace of mind. Your family may not be able to come up with $8,000 to $12,000 to cover unexpected final expenses, so it makes sense to get a low contribution monthly plan where you pay as low as $7.49/mo. towards these expenses ($2,000 benefit for Female, age 50 = $7.49/mo. GUARANTEED FIXED for LIFE, if in good health at the time of policy purchase). The best part is that once you purchase the policy RATES ARE FIXED FOR LIFE so the younger you start, the cheaper and affordable it is.

For example, it’s only $15 to 25 monthly for a 50 years old to get a final expense policy (with price locked in for the rest of her life) but if instead you choose to wait until you’re well in your 70s or 80s, the cost will be much higher as you can see below. Save on final expense by enrolling today!

Benefits are available from $5,000 to $50,000

Check your rates below:

Also ask us about the ACCIDENT LIFE INSURANCE options

| LIFE INSURANCE | MEDICARE | APPLICATION | CONTACT |

Email:OpenCareInsurance@OpenCareSeniors.com Call: OpenCare 321-222-9443

Open Care Seniors – National Insurance Brokerage – 4755 9th St N, Naples, FL 34103

I’m on dialysis, does my rate increase and do I have to wait 2 years to be full vested.

Hi, Fitzroy! Due to dialysis you qualify for what is called GUARANTEED ISSUE WHOLE LIFE, rates will differ than those listed above, and you have immediate benefit payable on death due to accident, but in case of death due to illness in the first two policy years the benefit will be all premiums paid plus 10% interest. If death due to illness occurs at any time after the 2 year policy anniversary, FULL BENEFIT will be paid.

Please send us your DOB and state of residence and I’ll send the Guaranteed Issue rates.

I would like to have final expense plan for my partner.

He is 67 yrs old. Feels there is no need for a healthy man to obtain this. I beg to differ.

Please send me a quote for the insurance. I need to have something to fall back on if this were needed.

The two year period I just found out about.

Diane, if health is relatively good and he’s willing to answer a few medical questions (but no blood test or medical exam needed)- then the waiting period does not apply. The reason to apply for this coverage while somewhat younger and healthy makes sense because rates are lower, and locked-in for life (rates never increase after policy is purchased). The danger of waiting until too old or too sick is that you can become uninsurable or remain with the only other option: Guaranteed issue which has the “waiting period”. I will send you rates by E-mail.

I would like to have final expense plan for my partner.

He is 67 yrs old. Feels there is no need for a healthy man to obtain this. I beg to differ.

Please send me a quote for the insurance. I need to have something to fall back on if this were needed.

The two year period I just found out about.

Diane, I replied in the other thread. No waiting period if healthy.

Just to draw a parallel: you don’t try to get car insurance after you total your car, same with life insurance – it’s cheaper to get it when healthy and still insurable.

I need senior insurance do make sure my family doesn’t pay for my expenses and i need no medical exam and locked-in price and also, benefits don’t decrease with age and I’m in good health and when do I pay? I also do not want agent calling me or coming to house; just send me form in mail!

I need senior insurance to pay for my expenses and not my family. I do not want agent calling or coming by to sell-just send me info. I am in generally good health. No medical exam no decrease in benefits and price locked In. How much do I pay and i need 30,0000 insurance coverage and I’m 67. What say u or what do u have? Thanks.

Hi, Sandy! I have replied to your email. No agent needs to come see you, no exam or blood test needed, benefits and premium are fixed for life. Application is done over the phone, with electronic signature (email confirmation).

I have tried to post a comment twice with no reply

I do not want agent coming to house. I am 67 and in good health, do not want medical exam, benefits to decrease, locked in rates and i need to know how much I’ll pay. I want 30,000 insurance policy. Thanks.

Sandra, please check your email.

I have type one diabetes I’m 60 years old I’ve had diabetes for 50years and have it well-controlled my last A-1 C was 6.5 do you ensure me? What are my rates and benefit? Pat

Neil, $56.88 for $10,000 benefit – these are Standard rates (not preferred due to diabetes).

Hi,

My father is 75 years old and cannot afford life insurance. I am looking for something to help with final expenses. Between $7,000.00 – $10,000.00 is what I’m inquiring about. His health is not good, he’s diabetic, on dialysis with congestive heart failure, hypertension. Is there something I can get for him. Also, he lives in Georgia.

Yes, Angela! You can still get him coverage, it’s called Guaranteed Issue Final Expense whole life – benefit amount and rates are locked-in for life once the policy is purchased – some waiting period may apply due to heart issues and dialysis. I’ll reply by email.

Hi my name is Gwendolyn Haythorne, I’m looking for final expenses for my mother she on a fixed income and reside at supportive living center. My mother has dementia and doesn’t have life insurance, please help me.

Hi, Gwendolyn! Yes – even with your mom in an assisted living center and with dementia, she can get a Guaranteed Issue plan – but it has certain limitations, like a “waiting period” for death due to illness or natural causes. I’m sending you an email with more details. You didn’t provide her mom’s age or DOB, so I didn’t include rates here.

Hi, my name is Mildred Mannings. I am inquiring about senior insurance to pay for my final expenses. I do not want agents calling or coming by to sell-just send the cost based on the following: I do have hypertension and have had it for 44 years. I have been and is still on medication which is under control. I have recently been diagnosed with breast cancer, which I have had surgery to remove it. I was told by the Surgeon that he removed all of it. The cancer was 1.8 centimeters in size. Could you please give me a quote on $30,000 coverage. I am 75 years old.

Hi, Mildred!

Depending when the cancer was treated and how long you’ve been cancer-free:

– if in the last 24 months: then you can get GUARANTEED ISSUE rates, with a “waiting period” and graded benefit.

– if over 2 years ago: you qualify for the LOWEST rates (preferred).

Details sent in email.

I would like a $25,000 policy.

Hi, Leslie! What’s your age or DOB? State? Taking any meds?

I would like a whole life ins policy for 10,000.

Please check your email. I have sent the rates.

Hello,

My mother is 78 years old on a fixed income and cannot afford life insurance. Her health is fair she had hypertension and COPD (asthma). I want to get some insurance to help with her final expenses. Also she lives in a different state than me she lives in Oklahoma. I’m inquiring regarding coverage for $20,000 can you be of assistance ? Thank you.

Deborah, due to current age it’s $75/mo for $5,000 benefit. But she’ll lock in the price for life (that’s why it’s recommended to get this coverage earlier in life to lock in the price when younger and healthier).

My mother is 63 years old. She’s not able to afford any life insurance.She has Congestive Heart Failure and had a stroke. Is she eligible for this insurance and what are the rates for her?

Yolanda, YES – she can still get it; $8,000 benefit would cost her $46 per month – rates fixed for life.

my mom is 81 and currently on oxygen for copd has been in hospital several times for her breathing. would she qualify for the end of life insurance and what is the monthly cost if so?

Debra, YES – you can get this for your Mom, she does qualify for Guaranteed Issue from $90/mo. Please contact us at Info@OpenCareSeniors.com

My mom is 79 years old never smoked and she’s battling cancer, does she quality for the final expense insurance plan and how does this plan work, because I want to purchase the plan.

Respectfully,

Dr. Shelton D. Wright

Hi I am 51 yrs old and I have Lupus what plan if any do you have for me?

I am 65 yrs old with type 2 Diabetes (under control) and high blood pressure also under control.

What would a $10,000 policy cost?

Hello my mom is 86 doesn’t smoke and is in decent health. No debilitating diseases . We are looking for 10 to 15 or 20 for final expenses

Is there any?

Please send me rates for $10,000 Open care senior plan

l3santh@2ol.com

just looking for a good life insurance for me when my time comes my granddaughter wont have to worrie about anything

Rena, please give us a call (321) 222-9443 for rates.

I’m 40 years old on Dialysis in Illinois and would like Final Expense Insurance.

Martin, we can help! Please call us at 321-222-9443

My mother lives in Virginia and does not have life/funeral expense insurance. She is a 65 year old widow and a smoker. Upon beginning a policy, when does it become effective? Some insurance companies require a 2 year wait period, etc. How much would an $8,000 – $10,000 policy’s monthly premium be for her? How long has your company been in business? Do you have a Better Business Bureau rating or any articles/associations that rate your company? Any information is greatly appreciated.

Thank you,

Joy

Joy, of course we can help! Give us a call and we’ll set her up with the lowest rates. We’re working with insurance companies that have been in business for over 100 years, are A+ rated and stable financially.

If final expenses insurance is chosen and i get 10k and my expenses only turn out to be 6k what happens with the difference?

Donna, the full value of the policy is disbursed to the beneficiary, to be spent as necessary. Any additional funds left over after funeral expenses are theirs to use as they see fit. Please give us a call to help you start coverage!

Hi. We have been looking for life insurance for my husband. He has been diagnosed with cirrhosis. He is 61. Is he eligible for coverage?

Yes, we can offer coverage. Call us and we’ll help you start an application.

I am inquiring on behalf of my mother. She is a very healthy 87 years young and only takes three prescriptions plus eye drops, all of which are preventative care. She wants to know if she qualifies, the terms and how much monthly.

Kat, yes – your mom qualifies for coverage. I emailed you the rates. You can also check the rates here